In 2023, a federal SBA 504 loan facilitated through Adams Economic Alliance helped small business owners Timbrel and Scott Wallace purchase the property at 17 Lincoln Square, which houses their popular gift shop, Lark – A Modern Marketplace.

GETTYSBURG, PA (January 18, 2024) – Adams Economic Alliance facilitated nearly $2.5 million in low-interest loans to Adams County businesses in 2023, and the organization is gearing up for several new 2024 loan programs—not only available to Adams County business, but potential homeowners as well.

The Alliance is comprised of three organizations that, combined, act as a free resource for Adams County business recruitment, relocation, expansion and support. Robin Fitzpatrick, Alliance President, invites individuals and businesses to become 2024 Alliance Investors, the organization’s annual membership program. Investor levels are open to individuals, local municipalities, businesses of all sizes including corporate investors, with details and signups available on the Alliance website, AdamsAlliance.org.

“Our mission is to support a healthy economy through planned development, affordable workforce housing, jobs that pay living wages and transportation for all. The Alliance is here for the greater community good, happy to meet with any and all business owners, from entrepreneurs and farmers launching their dreams, to small, medium and large businesses of all types seeking low-interest loans and other programs to accelerate their growth,” said Fitzpatrick.

“Alliance Investors directly support those entrepreneurs, farmers, business owners, partnerships and community ties,” said Fitzpatrick, “which builds community growth for the greater good of Adams County.”

In 2023, the Alliance facilitated $2,466,500 in state and federal financing to seven Adams County businesses. This brings the Alliance’s all-time economic impact to $430 million in loans facilitated to 200+ businesses representing a variety of industries, across all geographical areas of the county.

“These are all extremely positive and hopeful economic indicators that Adams County businesses are launching, diversifying and gearing up for greater success in 2024,” said Kaycee Kemper, Alliance Vice President.

Those seven businesses and loans are:

- Timbrel and Scott Wallace, Wallace Real Estate Group LLC, Gettysburg – $428,000 – low-interest federal Small Business Administration (SBA) loan in partnership with PNC Bank to purchase the property at 17 Lincoln Square that houses their business Lark – A Modern Marketplace.

- Mary Lynn Martin, Hickory Bridge Farm Restaurant, Orrtanna – $71,000 low-interest, fixed-rate, 15-year Pennsylvania Industrial Development Authority (PIDA) loan for an HVAC system in their Red Shed event venue.

- Justin and Jennifer Martin, New Oxford – $400,000 low-interest, fixed-rate 15-year PIDA loan to construct two hen houses.

- The Historic Round Barn & Farm Market operated by Knouse Fruitlands – $125,000 low-interest, 15-year PIDA loan for a new roof on the historic and iconic barn and business.

- Kyle and Kaitlyn Grim, Beaver Creek Angus, East Berlin and Thomasville – $287,500 low-interest, 15-year PIDA loan in partnership with ACNB Bank to purchase an 80-acre Thomasville farm and residence.

- John F. and Barbara S. Zook, Gettysburg – $560,000 low-interest First Generation Farmer Loan in partnership with Bank of Bird-in-Hand to purchase a 48-acre Franklin Township dairy farm.

- Covington Plastic Moldings, New Oxford and West York – $595,000 low-interest, 15-year PIDA loan in partnership with ACNB Bank to purchase a West York warehouse.

The Alliance’s three organizations include: the Adams County Economic Development Corporation (ACEDC) which administers low-interest loans through the Commonwealth of PA as well as the federal Small Business Administration; the Adams County Industrial Development Authority (ACIDA) and the Adams County General Authority (ACGA) are involved in land development and issue bonds as another tool for financing.

Additionally, the Alliance is launching and administering two new revolving loan programs in 2024—one for businesses and another for potential homeowners—with qualified applicants invited to apply:

- The Adams County Homebuyer Assistance Program has a goal of assisting 25 households become homeowners by 2025 by lending $10,000 for down payments or closing cost assistance.

- The Spark Loan Program, welcoming its first applicants, is designed to spark investment and growth within the local small business community.

The Adams County Homebuyer Assistance Program’s goal is to help those who work in Adams County to also become Adams County homeowners. The Alliance is grateful to have received $323,000 in seed money awarded by the Adams County Commissioners. This seed money comes by way of federal American Rescue Plan Act of 2021 (ARPA) funding in response to the economic effects of the COVID-19 pandemic, which our commissioners put into a grant program, the Adams Rescue and Recovery Fund (ARRF).

“Attracting and retaining talent in Adams County is a challenge, due to the current cost of affordable workforce housing,” said Fitzpatrick. “We’ve seen some of the quickest home sales in recent years with sellers receiving full asking prices, leaving working families and first-time homebuyers priced out of homeownership. Our program is designed to stem this tide.”

The median cost of an Adams County home in 2016 was $250,000. By the fall of 2022, the median rose to $279,750. The share of first-time buyers fell to 26 percent, plummeting to the lowest level in four decades nationally.

The Alliance has partnered with @home in Adams County, an initiative operated under South Central Community Action Programs (SCCAP) and supported by the Adams County Community Foundation, to establish the revolving Adams County Homebuyer Assistance Program.

Adams County Homebuyer Assistance Program details include:

- At least one person living in the household must be employed by an Adams County employer.

- The program will lend $10,000 for down payment or closing cost assistance.

- There is no monthly payment and zero interest.

- The loan would be repaid when the home is either refinanced or sold. The Alliance takes a lien against the property.

For more information, or to apply to the Adams County Homebuyer Assistance Program, contact Brady Rodgers, the Alliance’s Director of Business and Community Outreach at [email protected]

or 717-334-0042, extension 4. Banks, real estate agents and Adams County employers are welcome to contact Brady for additional details as well.

The Alliance is establishing the Spark Loan Program as a revolving loan program available to Adams County’s small business. Initial federal funding in the amount of $236,930 was secured by the Alliance in a highly-competitive awarding process spanning all Pennsylvania economic development organizations. The Alliance hopes to secure two additional funding streams, to further strengthen the program.

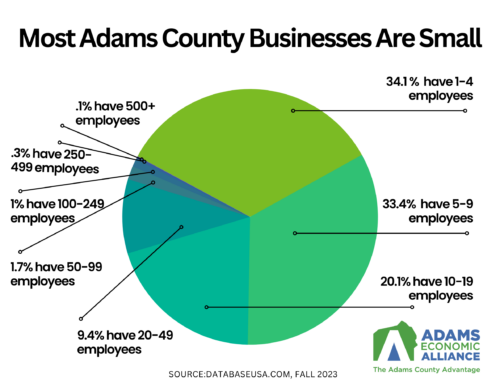

Borrowers must be a small business, defined as a for-profit enterprise with less than 500 employees. All types of small businesses are eligible and encouraged to apply for the Spark Loan Program, including retail and service industries, socially and economically disadvantaged individuals (SEDI-owned businesses) and very small businesses (VSBs).

Spark Loans may be used for the following:

- Acquire equipment or inventory

- Produce, manufacture or deliver goods or services

- Purchase real estate, do construction, renovation or tenant improvement

- Pay soft, start-up or franchise costs

- Acquire working capital

There are currently 3,359 businesses—99.9% of Adams County’s businesses—defined as small businesses. That’s according to fall 2023 figures provided by DatabaseUSA.com to the South Central PA Workforce Development Board (SCPa Works), one of the Alliance’s regional partner organizations. More than a third (35.1%) of Adams County’s businesses are VSBs employing between one and four people.

Spark funding was awarded to the Alliance by the Pennsylvania State Small Business Credit Initiative (PA-SSBCI), via federal funding provided by the Federal State Small Business Credit Initiative (SSBCI), reauthorized by the American Rescue Plan Act of 2021 (ARPA) as a response to the economic effects of the COVID-19 pandemic. SSBCI is administered by the U.S. Department of the Treasury (Treasury).

For more information or to apply for a Spark Loan, contact Kaycee Kemper, Alliance Vice President, at [email protected] or 717-334-0042, extension 2.

The Adams Economic Alliance is comprised of three organizations: The Adams County Economic Development Corporation (ACEDC), the Adams County Industrial Development Authority (ACIDA) and the Adams County General Authority (ACGA). For more information, see adamsalliance.org, or follow AEA on Twitter (@AdamsAlliance), Facebook (Facebook.com/AdamsAlliance) and LinkedIn (Adams Economic Alliance).

MEDIA CONTACT: KAREN HENDRICKS / HENDRICKS COMMUNICATIONS / 717-253-3553