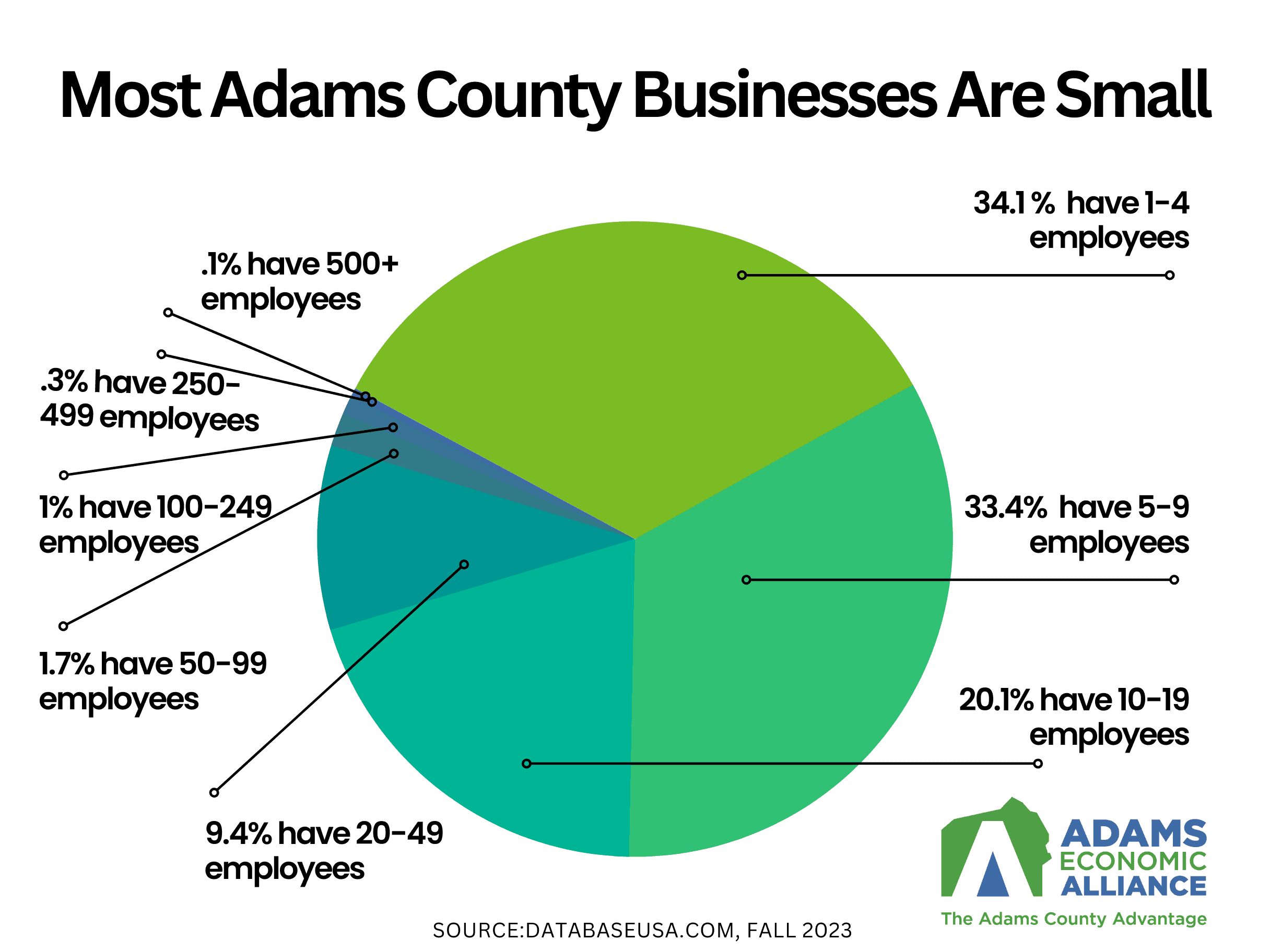

The composition of Adams County’s business community is 99.9% small businesses, and are eligible to apply for Spark Loans, a new program available to Adams County small businesses through Adams Economic Alliance.

GETTYSBURG, PA (November 10, 2023) – Adams County’s small businesses are invited to apply for Adams Economic Alliance’s new Spark Loan Program, designed to spark investment and growth within the local small business community.

The program is launching as we approach Small Business Saturday on November 25—a day within the busy holiday shopping season to celebrate, support and recognize the role unique small businesses play in local, state and national economies. Nearly all Adams County businesses are small businesses, defined as those employing less than 500 people.

“We know that 99.9% of our Adams County business community is comprised of small businesses,” said Robin Fitzpatrick, Alliance President. “Not only are small businesses the lifeblood of Adams County’s economy, providing employment, vital goods and services, but we recognize and salute small businesses for their ingenuity, entrepreneurship and the vibrance they bring to our communities.”

The Alliance is establishing the Spark Loan Program as a revolving loan program available to Adams County’s small business for years to come. Initial federal funding in the amount of $236,930 was secured by the Alliance in a highly-competitive awarding process spanning all Pennsylvania economic development organizations. The Alliance hopes to secure two additional funding streams, to further strengthen the program.

“Many of Adams County’s small businesses are continuing to rebuild, in the wake of the pandemic,” said Kaycee Kemper, Alliance Vice President. “It’s our hope that the Spark Loan Program provides a much-needed boost to help small businesses regain their footing and set their sights on new goals, projects and dreams.”

Borrowers must be a small business, defined as a for-profit enterprise with less than 500 employees. All types of small businesses are eligible and encouraged to apply for the Spark Loan Program.

“Traditionally, we haven’t been able to reach retail and service industries as much as we’d like, so we are thrilled that Spark Loans are now an option,” said Kemper. “Additionally, socially and economically disadvantaged individuals (SEDI-owned businesses) and very small businesses (VSBs) are eligible. It is going to be especially rewarding to reach these very special sectors of our business community.”

Spark Loans may be used for the following:

- Acquire equipment or inventory

- Produce, manufacture or deliver goods or services

- Purchase real estate, do construction, renovation or tenant improvement

- Pay soft, start-up or franchise costs

- Acquire working capital

- Refinance existing debt (conditions apply)

There are currently 3,359 businesses defined as small businesses in Adams County. That’s according to fall 2023 figures provided by DatabaseUSA.com to the South Central PA Workforce Development Board (SCPa Works), one of the Alliance’s regional partner organizations. More than a third (35.1%) of Adams County’s businesses are VSBs employing between one and four people, while another third (33.4%) employ between five and nine people.

Statewide, Pennsylvania is home to 1.1 million small businesses that employ 2.5 million individuals—about half of the state’s private workforce. Small businesses account for 99.6 percent of businesses in the Keystone State.

Spark funding was awarded to the Alliance by the Pennsylvania State Small Business Credit Initiative (PA-SSBCI), via federal funding provided by the Federal State Small Business Credit Initiative (SSBCI), reauthorized by the American Rescue Plan Act of 2021 (ARPA) as a response to the economic effects of the COVID-19 pandemic. SSBCI is administered by the U.S. Department of the Treasury (Treasury).

Numerous additional loan and grant programs are available to Adams County businesses, entrepreneurial start-ups and farmers, including low-interest, fixed-rate financing, through the Alliance.

To apply for a Spark Loan, or for more information on additional loan programs, contact Kaycee Kemper at gro.ecnaillasmada@repmekk or 717-334-0042, ext. 2.

It is the mission of the Adams Economic Alliance to develop and implement creative community-based strategies to enhance economic opportunity and foster a dynamic framework for balanced growth and development through the Adams County Economic Development Corporation, Adams County Industrial Development Authority and Adams County General Authority. For more information, see adamsalliance.org, or follow the Alliance on Twitter, Facebook and LinkedIn.

MEDIA CONTACT: KAREN HENDRICKS / HENDRICKS COMMUNICATIONS / 717-253-3553