Nathan Arentz of Littlestown feels like he knows Adams County’s best-kept secret.

He was able to buy his first home at the beginning of the year, at the age of 25, thanks in great part to a $10,000 loan with zero-interest and no-payments.

Sound too good to be true? I can assure you—it’s completely true.

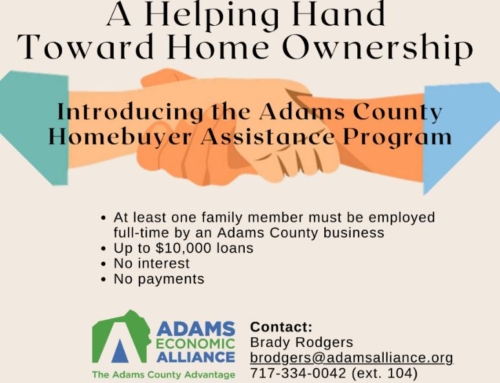

The loans are available through our organization, Adams Economic Alliance. They’re part of a fairly-new program called the Adams County Homebuyer Assistance Program.

It’s really pretty simple: We lend $10,000 to assist homebuyers with down payment or closing costs. To qualify, at least one person in the household must be employed by an Adams County employer. There is no monthly payment and zero interest. The loan is to be repaid when the home is either refinanced or sold; the Alliance takes a lien against the property. That’s it, in a nutshell!

Three Adams County families have recently become new homeowners thanks to this program, including Nathan Arentz, as mentioned.

“If we hadn’t gotten this loan, we wouldn’t have been able to buy the house—it was a make-or-break situation,” said Arentz, who purchased a two-story brick home he’d been renting for several years along Baltimore Pike.

Arentz, a first-time homeowner, tried going with first-time homebuyer loans through the USDA and FHA, but he wasn’t eligible. One of the issues was the location of the home’s well, which was too close to the home to qualify for a federal loan program. Going with a conventional loan wasn’t an option for him either because, like many prospective homebuyers, he didn’t have enough money saved up for the downpayment.

That’s where an extra $10,000 can make all the difference—and that’s exactly why we designed this program, as a boost to help hard-working Adams Countians attain their dream of home ownership, leading to greater financial stability.

Nathan and Brianna Arentz, holding their weeks-old son William, recently purchased their Littlestown home thanks to a $10,000 zero-interest loan from the Adams County Homebuyer Assistance Program administered by Adams Economic Alliance.

Here in Adams County, as well as nationwide, the real estate market is tough. The median price of an American home rose 4.8% year over year, to $396,900 in January, according to the National Association of Realtors. While the median price in Adams County isn’t quite as high, we’ve still experienced a considerable price hike. Adams County’s median home was priced at $319,900 in October of 2024—up from $279,750 in the fall of 2022, and $250,000 in 2016.

Rising prices and a competitive housing market—with many homebuyers offering above-asking prices— puts the American dream of home ownership out of reach for many people, leaving them in a seemingly-never-ending cycle of escalating rent payments rather than home equity.

Recognizing the need for the program, the Adams County Commissioners awarded the Alliance $323,000 in seed money to launch the Adams County Homebuyer Assistance Program last year. Funding originated from the federal American Rescue Plan Act of 2021 (ARPA), in response to the economic effects of the COVID-19 pandemic, which the commissioners put into a grant program, the Adams Rescue and Recovery Fund (ARRF).

Additionally, the Alliance has partnered with @Home in Adams County, an initiative operated under South Central Community Action Programs (SCCAP) and supported by the Adams County Community Foundation, to establish the Adams County Homebuyer Assistance Program.

The busy spring housing season is upon us. Please tell everyone you know about the Adams County Homebuyer Assistance Program! We can’t wait to help more Adams Countians like Nathan Arentz afford home ownership.

“It made all the difference,” said Arentz. And the timing couldn’t have been better. The week after he and his wife settled on their home, they welcomed the birth of their first child. What a happy ending—or really, in their case, a beautiful beginning to their life together.

For more information, or to apply to the Adams County Homebuyer Assistance Program, contact Brady Rodgers at gro.ecnaillasmada@sregdorb or 717-334-0042, extension 104. Banks, real estate agents and Adams County employers are also welcome to contact Brady for additional details, to spread the word to their clients and employees.

This column originally published in the Gettysburg Times, March 13, 2025.