Back in February, our column announced that plans were underway to launch a revolving loan fund to help Adams County’s small businesses get back on their feet following the pandemic. And now those plans are becoming a reality!

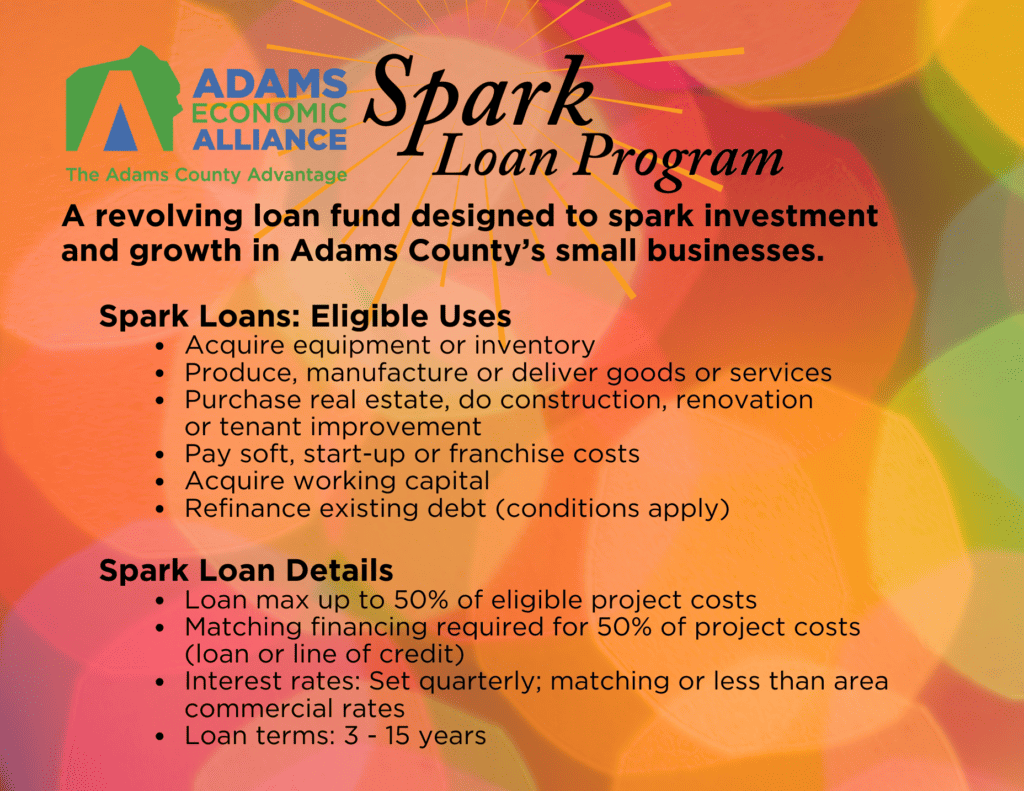

Introducing the Spark Loan Program, designed to spark investment and growth in Adams County’s small businesses! Borrowers must be a small business, defined as a for-profit enterprise with less than 500 employees. And while all types of small businesses are eligible and encouraged to apply, there are several groups of businesses we especially want to reach.

Traditionally, we haven’t been able to reach retail and service industries as much as we’d like, so we are thrilled to offer this loan program to assist them. Additionally, socially and economically disadvantaged individuals (SEDI-owned businesses) and very small businesses (VSBs) are eligible. It is going to be especially rewarding to be able to lend these helping hands.

As for guidelines, here’s how small business owners can use Spark Loans:

- Acquire equipment or inventory

- Produce, manufacture or deliver goods or services

- Purchase real estate, do construction, renovation or tenant improvement

- Pay soft, start-up or franchise costs

- Acquire working capital

- Refinance existing debt (conditions apply)

This new program is part of the Pennsylvania State Small Business Credit Initiative (PA-SSBCI), established with federal funding through the Federal State Small Business Credit Initiative (SSBCI), which was reauthorized by the American Rescue Plan Act of 2021 (ARPA) as a response to the economic effects of the COVID-19 pandemic. SSBCI is administered by the U.S. Department of the Treasury (Treasury).

It is not often that we toot our own horn, but I truly want Adams Countians to know how hard we went to bat, to bring these dollars into the county and launch this vital program. Funding was an extremely competitive process between nearly all economic development organizations across the state. There is strength in numbers, so the Alliance developed a strategic plan and partnership with the EDC Finance Corporation, based in Lancaster, to administer these loans to the Adams and Lancaster County communities together.

I have honestly dreamed about starting a revolving small business loan program for years. Our first round of funding available to Adams County small businesses is $236,930 with two additional tranches to come.

Once we begin the lending process, the program will constantly reseed and replenish itself, helping Adams County small businesses for years to come. Imagine the bright sparks we’ll see in our local economy, in businesses and lives changed! For more information, reach out to me at [email protected].

Kaycee Kemper is Vice President of Adams Economic Alliance, which comprises three organizations: The Adams County Economic Development Corporation (ACEDC), the Adams County Industrial Development Authority (ACIDA) and the Adams County General Authority (ACGA). Follow us on Twitter (@AdamsAlliance), Facebook (Facebook.com/AdamsAlliance) and LinkedIn (Adams Economic Alliance).

This article originally published in the Gettysburg Times, June 8, 2023